The Home Depot's $18.25 billion purchase of SRS Distribution has become a Rorschach test for dealers and analysts, generating diverse interpretations of both underlying intent and potential outcome.

Some view the deal--the biggest since Builders FirstSource took over BMC at the end of 2020--as a way for The Home Depot (THD) to buy some of the expertise it needs to serve what it calls "the complex pro." Others suggest the acquisition is a way to better compete against Amazon. People are wondering. whether all the purchases lately by ABC Supply and Beacon are responses to the competitive pressure they feel.

Then again, at its heart this purchase could be something much simpler: A way for The Home Depot to grow its total addressable market by $50 billion by absorbing a company with annual sales now nearly $10 billion. Synergy needn't figure into the reasoning if all you want to do is add a market segment. As Sigmund Freud is reputed to have said, sometimes a cigar is just a cigar.

Assessing SRS' Assets--and How It Does Business

"SRS has an expansive network of distribution assets, branches, a strong and relationship-driven salesforce, and in-house delivery capabilities which have driven strong internal growth and are pieces HD can leverage for its own complex Pro initiatives," Max Rakhlenko of TD Cowen wrote. "Additionally, SRS can help HD refine and scale its order management and trade credit programs that are critical in winning business with the cross-shopping complex Pro."

"This will likely be seen as an opportunity to learn more about this pro, including purchasing habits credit terms and usage, as Home Depot’s trade credit program is still in early days," said Chris Beard of John Burns Research and Consulting. "Home Depot also likely sees the wave of big-ticket remodeling projects that are coming due to homes in what we call prime remodeling years."

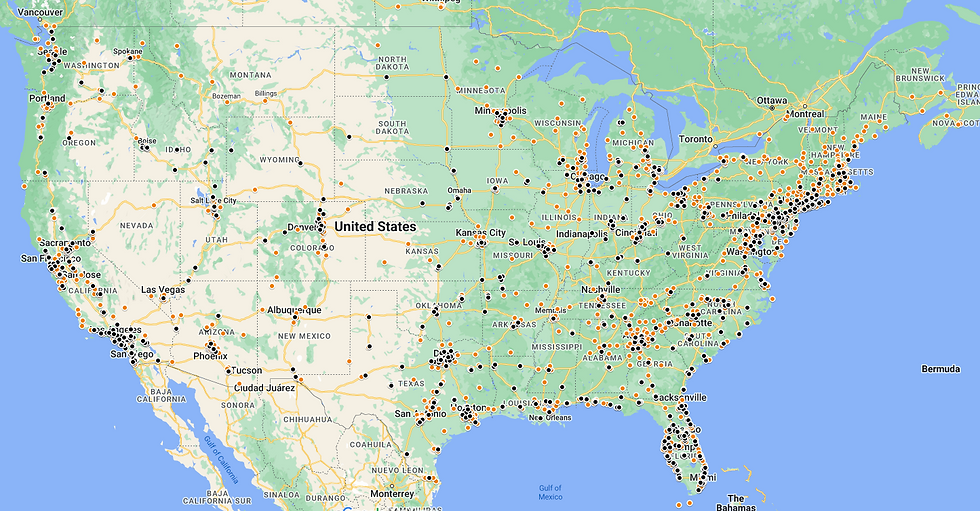

Beard, like others, sees SRS' 760 locations and 4,000+ delivery vehicles as a way for The Home Depot to expand its service capacity. For all its size, The Home Depot is still largely a cash-and-carry business. A pro dealer has to be a trucking company and a bank along with a source of building materials. Buying SRS enlarges THD's capacities immediately.

Products, Pricing, and the Internet

The buyer for one major distributor noted that THD and SRS sell some of the same products, but quite likely don't pay the same price or enjoy the same terms. These manufacturers could be challenged if they find themselves have to negotiate simultaneously with THD and SRS buyers during the next contract renewal.

Meanwhile, Todd Tomalak of Zonda pointed out there are manufacturers who produce products for the pro that can't be acquired a Big Box, but can be bought through Amazon. "Our data suggests Pro Contractors are now starting purchasing more of these premium products through 'pure online' (Amazon, et al)," Tomalak wrote. "his acquisition is a first step towards Home Depot erasing the 'retailer/wholesaler' differential. Perhaps this [SRS deal] is as much about Amazon as Lowes."

SRS Is a Bolt-On Machine

It may be No. 1 by far today, but THD is set on growing sales and operating income at the fastest rate possible. That will require acquisitions as well as organic growth, and in this area SRS can help. It has acquired dozens of companies since its founding in 2008, and it has a reputation for absorbing them quickly. That includes having the acquired company on SRS Distribution's ERP system the day it officially joins.

What About Lowe's, Beacon, and ABC Supply?

Analysts have viewed the SRS deal as opening a wider gap between THD and Lowe's; indeed, the value of Lowe's shares started declining the day after the deal was announced March 28 and then were battered by the recent decline in the overall stock market. But if anything, Wall Street's opinion of The Home Depot is even worse.

Pro dealers historically record lower profit margins than home centers. TD Cowen estimates SRS' 2023 earnings before interest and taxes were 5.3% vs. THD's 14.2% EBIT. If SRS stays at that level, it will depress THD's future margins. In addition, THD plans to borrow $12.5 billion to buy SRS and is suspending share repurchases until its debt-to-earnings ratio returns to normal. Neither factor adds to THD's attractiveness.

Ironically, one winner from the deal may be Beacon. Its share price has risen since the deal's announcement, and it has withstood the recent stock market slump. Stifel says the acquisition "highlights the defensibility of Beacon's model as THD would rather buy than build out its last-mile delivery network." Don't expect any change in Beacon's strategy to do both acquisitions and greenfield openings, Stifel adds.

Market estimates suggest that ABC Supply, Beacon, and SRS collectively have 55% of the entire roofing supply market. All are working hard to expand that share. Beacon has made four acquisitions for 23 locations already this year on top of nine deals for 22 locations in 2023. Meanwhile, ABC Supply has purchased 16 locations in three deals this year, and picked up another nine locations in three deals in 2023. Then there are the store openings: 34 for Beacon and 29 for ABC Supply since the start of last year. Both are determined to not let SRS make up any ground of them, regardless of who owns that company.

Comments